Nowadays almost everyone has an account in a bank and a credit card. Therefore, we are constantly engaged in some financial operations. What is more important to note here, is the fact that all our money-related activities are being recorded all the time. So all your income, expenses, borrowings and payouts are kept track of. Actually, your financial reputation is building each time you earn or spend money, click for cash from online lenders and so on.

If the income-expenses picture is more or less clear, the situation with loans and money borrowing may have more pitfalls than it seems to.

Of course, loans should not necessarily be big. Furthermore, not each of them is taken to cover some large business expenses or start a new business. Indeed, among all the variety of the possible credit options, quite popular are small (or personal) ones.

A bank loan may successfully enhance your well-being and insure for you in case of an emergency. Nothing is threatening about borrowing money from a bank if you do it wisely. Moreover, such small loans are the best helpers for everyone willing to build a good credit history. You may not ever decide to run your own business, which requires a lot of money to start. However, a flawless reputation will be a huge plus in any case.

What is a Credit History?

Okay, let’s determine the core points of credit history and its gist. Knowing this ensures you that you start from the right place and you have all the necessary awareness to have the moneylending process smooth and understandable.

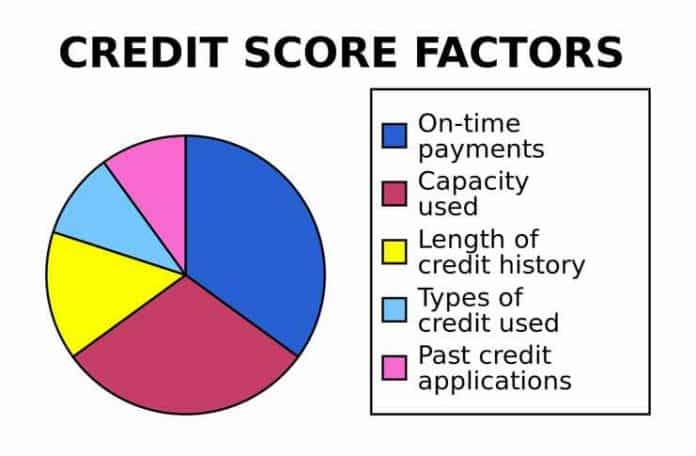

Credit history is a record of your ability to pay out the taken loans. They prove your financial responsibility. According to Investopedia, the record includes the following aspects:

• Amount of credit used

• Amounts owed

• Following payout deadlines

• Recent applications for credit

• List of credit accounts

• The amount of time that has passed since the time of the account opening

In addition, it includes data about bankruptcies, liens, or collections. This is all stored in a credit report.

As it is noted at America Saves, a credit report explains your credit history. It states when and where you applied for credit, whom you borrowed money from, and whom you still owe. Your credit report also tells you if you’ve paid off a debt and if you make monthly payments on time.

Which loans are considered small?

As understood from the title, small loans surely are limited in the amount. The edge maximum sum of such a loan may vary in different countries and sometimes even in different banks within one country, but frequently it is around $3000.

Apart from the quantity consideration, a small loan is a type of personal loan. Usually, they do not require collateral (some material items to ensure your payment, such as a house or a car). The reasons you can present to take a loan include emergency cases, and it is necessary to point out that such loans cannot be taken regularly.

How to build a good credit history?

Now, let’s get to the more practical side of the question: how to build a good credit history?

The first and foremost requirement is to make payouts diligently.

Here we can stop to take a closer look at this aspect in relation directly to small loans as a separate kind of money lending operations.

The core distinguishing feature of a small loan is, obviously, its size. What advantages does it give to you? The rules of a regular wise money lending are of course applicable to small loans too, and they even become much easier to follow.

To ask for any loan, it is highly preferable to create a financial plan. A detailed plan of both your further expenses and possible incomes. Also, another plan, showing how you are going to pay out the general sum. As you make your calculations, consider the following questions:

-

What are your sources of income?

-

Are they regular?

-

Will you manage to make payouts on time, without any financial struggles?

Most people will agree, that all of these calculations are much easier to make if the sum is small.

Small loans create a perfect background to learn how to build your cooperation with banks. Once you start small, you will get the possibility to learn the fundamental aspects and create a good reputation at the same time. It will not only make the future procedure of taking bigger loans easier but also teach you the basics of financial literacy on practice.

At this point, we can also review some useful tips for a money borrower, willing to build a good credit history. Apart from the mentioned above, keep in mind the following:

1. Always be aware of your current credit score.

2. Make a research of the most suitable bank or private money lender for you.

3. Choose the most suitable type of loan from all the available options.

4. Prepare all the necessary documents, such as a certificate of income, ID, etc.

5. Be ready to explain your reason for taking a loan.

Is it possible to “rebuild” my credit history, if I used to have payout delays in the past?

In a nutshell: for sure, nothing is impossible. Moreover, if you decide to ask for a loan after some missed payout deadline, most likely banks will offer you some limited sum. Still, it’s even better for you: you already know what your past mistakes were and how to start everything from scratch with a smaller amount of money. In any case, the most important thing is to be willing to learn something from your own experience.

Final words

A loan is not a trap or some tricky idea of a bank to fool you and take your money. Otherwise, this action would already be forbidden by law or at least would not be as widespread as it is now. There is just one and only “key to success” in terms of money borrowing: thoughtful approach. Simple as that. If you make conscious steps and wise decisions, a bank loan will only enhance your prosperity.